MileBug (LITE) app review: mileage tracker

Introduction

Just as its name would suggest, MileBug (LITE) - Mileage Log & Expense Tracker for iPhone and iPad allows you to track all of your vehicle expenses, and is especially designed for professional organizations such as businesses and charities.

The best mileage tracking apps for iPhone and iPad 2021This is definitely one of the better mileage and vehicle expense tracker apps I’ve seen in the Business and Finance categories of the App Store, and I’m thoroughly impressed by the level of functionality the developer has been kind enough to offer in this free Lite version.

GPS Integration

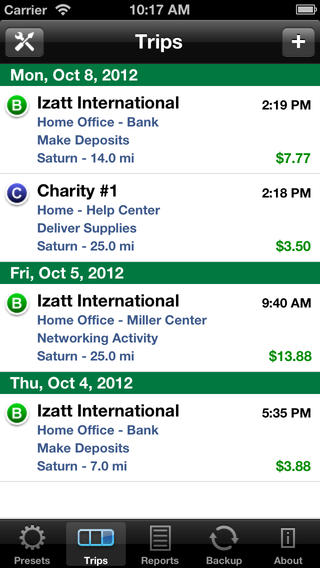

This is a fantastic app that you can use on a daily, weekly, or monthly basis to easily track all of your vehicle expenses in a personal or professional context, with the ability to record an unlimited number of vehicles.

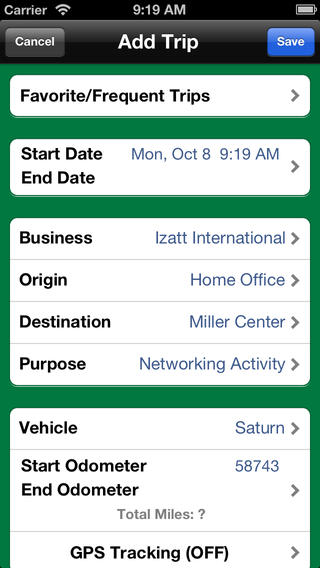

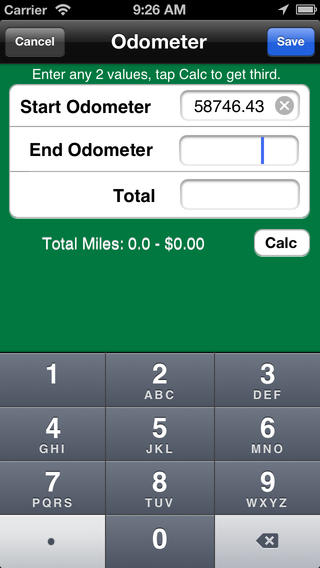

The best iPhone apps for saving moneyWith this app you can use your device’s integrated GPS to track your vehicle mileage in real time, as well as being able to add mileage data retrospectively by inputting odometer readings from your vehicle manually.

Create IRS-Compliant Reports

MileBug (LITE) - Mileage Log & Expense Tracker enables you to create customizable spreadsheet reports and share them with others online via email in .HTML and .CSV file formats, and the reports are also fully compliant with IRS regulations.

The best iPad apps for doing your own taxesFurthermore, you can save your most frequently used destinations for quick and easy reference; this is great for recording your daily commute or any trips you make regularly in your local area so that you don’t have to keep inputting the same mileage figures manually every time.

Pros & Cons

Pros

- Manage all of your business and personal vehicular expenses

- Create records for an unlimited number of vehicles

- Designed specifically for professional contexts including charities

- Use your device’s integrated GPS to track your vehicle mileage in real time

- Add mileage data retrospectively by inputting odometer readings manually

- Fully compliant with IRS regulations

- Provides full support for both metric and imperial systems

- Create customizable spreadsheet reports and share them with others online via email in .HTML and .CSV file formats

- Save frequently used destinations for quick and easy future reference

Cons

- There is nothing negative to say about this app

Final Words

MileBug (LITE) - Mileage Log & Expense Tracker is wonderfully designed, expertly developed, and clearly put together with a keen eye for detail and overall quality, so I’d definitely recommend using it on your iPhone and iPad for your own business.