Acorns - Invest Spare Change app review: invest your spare change 2021

Introduction

Have you ever wanted to invest your spare change from everyday transactions into your very own diversified portfolio? Worry not! Acorns iPhone stock trading app has come to your rescue.

The best fax apps for iPhone 2022This stocks app for iPhone was developed by Acorns and is also compatible with iPad, and iPod touch devices to assist you to easily get started in minutes anytime and anywhere.

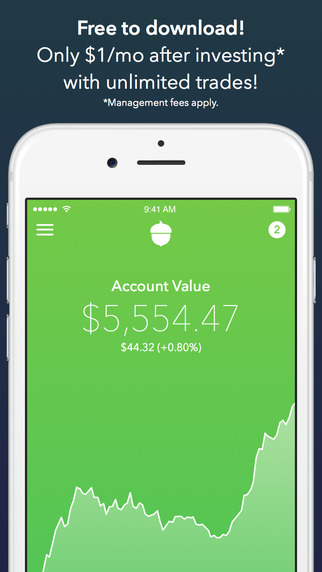

This is one of the best stock trading apps for iPhone and iPad an it's FREE to download, so you don’t have an excuse for missing out on this great transition to riches!

Let's dig deeper into our Acorns app review for more details on the features and functions of this stock trading app.

How it Works

The Acorns app seeks to maximize your expected returns for a given amount of risk by carefully diversifying across multiple asset classes.

The best iPad apps for tracking billsThe mathematical framework used for this diversification is called Modern Portfolio Theory which assists to you invest change from everyday purchases. The app automatically re-balances your portfolio during market fluctuations to mitigate risk and optimize returns.

Acorns invests in low-cost ETFs and passes these savings on to the users in the form of low management fees. Using Acorns for a year can cost less than some traditional brokers charge for two trades. Download Acorns now for FREE! Charges do not apply until you decide to invest.

You can always choose to withdraw anytime with no fees; this app is incredibly flexible to your needs and demands anytime and anywhere.

Best Features

This app chiefly features Intelligent Investment with its simple and intelligent automatic investment system which not only helps you invest regularly but also optimizes your investment through diversification and automatic re-balancing.

The best iPad apps for PayPalIn other words, Acorns buys low and sells high without you having to keep an eye on things. This awesome app assures you a high-tech level of security; this is because your peace of mind is Acorns' highest priority.

Acorns protects your information, prevents unauthorized account access, and notifies you of unusual activity.

With this app’s incredible low fees with no commissions. It’s always free to move your money into and out of Acorns. Using Acorns for a year costs you less than what most traditional brokerages could have charged for just two trades.

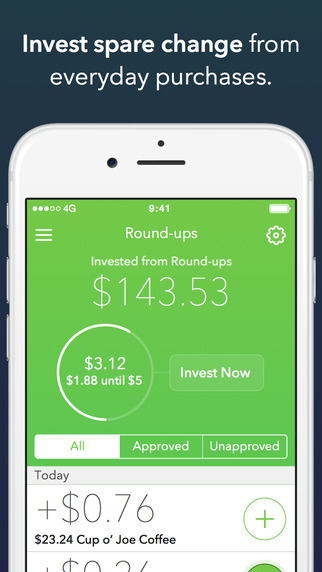

This app has some exciting features such as the Round-ups screen, making it easier than ever to see how much you’ve invested from Round-ups and your recent transactions at the same time. It also has a breakdown of how your holdings of the different Index Funds contribute to your overall account value.

You can simply tap the account value number on the screen to see the breakdown. However, with its bug fixes and general usability improvements, your app experience comes no better!

The biggest app update for 2021 has been the Money Hub which is the centralized place to see all of your recurring and direct deposits.

Pros and Cons

Pros

- Intelligent investing

- Bank level security

- Low fees

- Automatic rebalancing

- FREE to download

- Diversified portfolio

Cons

- The fingerprint ID doesn't work all the time, I hope something will be done about that

Final remarks

Once you invest, Acorns is only $1 per month for accounts under $5,000 and 0.25% of the account balance per year for accounts of $5,000 or more.