Alliant Mobile Banking app review: banking on the go 2021

Introduction

The Alliant Mobile Banking app is available to people who are presently Alliant Bank customers. This good iPhone banking app covers just about every aspect of banking available.

The best accounting and bookkeeping apps for iPhoneMaking deposits by taking a picture of your check, checking balances, tracking activity, and more. Your bank credit card information is also available as well through this iPhone banking app. Alliant’s Mobile Banking app seeks to take the hassle out of banking and add convenient banking wherever you are.

Keep reading this Alliant Mobile Banking app review for more information.

What is Available?

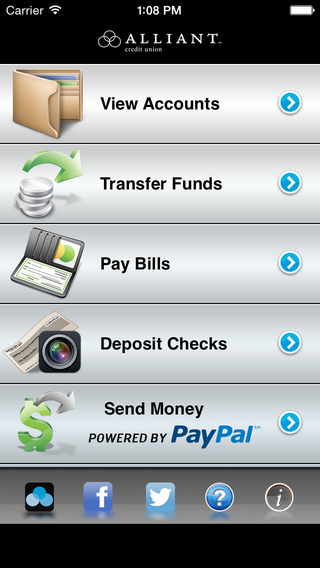

After you download the Alliant Mobile Banking app, almost every aspect of online banking is available to you as well as some extras. You can keep track of your balance and activity at a glance, transfer money between accounts at any time, and view transfer history, including your credit card history.

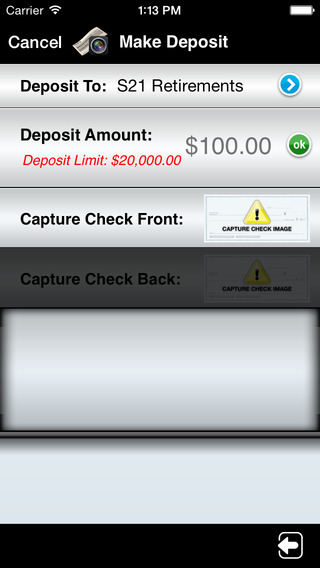

The best iPhone apps for bankingYou can pay bills and deposit checks using their photo deposit feature. A new and exciting feature is the use of PayPal’s Person to Person (P2P) choice to pay family and friends from your account instantly.

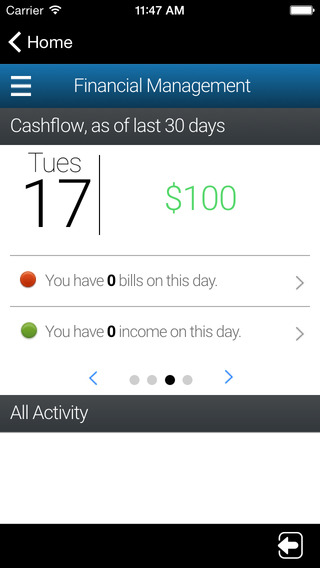

To keep everything associated with your account running smoothly, they have incorporated a very powerful personal finance tool that keeps you in the know at all times.

Need to withdraw cash? The app shows you which of the 80,000 free ATMs in Alliant’s network is closest to you. These ATMs offer free cash withdrawal as well as free deposits.

Checking and Savings Account Rules

The same rules that apply in Alliant's branches apply to the mobile banking system. Want to transfer from checking?

The best iPhone apps for bankingNo worries, there are no limits to the amount of transfers from your checking account. Our savings account is regulated by federal laws that state no more than six transactions per month can come from your savings account.

There is also a three-transfer limit to withdraw funds from savings by debit or check to third parties; however, your savings account does still allow unlimited ATM transfers, transfers done in person at bank facilities, through the mail or for any Alliant Credit Union loan payment.

These rules are federal and fees, account suspension, or closing your account may be possible if these regulations are violated.

You can breathe easy knowing, though, that your account is safe on your mobile device. All information is encrypted and no sensitive information gets stored on your device.

Pros and Cons

Pros

- The convenience of your account at your finger tips

- Easy photo deposits from anywhere

- Track your account activity

- Money transfer via PayPal

- Pay bills

- 80,000 ATMs for free use

Cons

- Must have an Alliance Bank Account already set up (checking and savings)

- No transfers allowed to other banks

- No credit report like is available when on computer

- Help page impossible to load

- Constant crashes when switching features

- No Touch ID login so it's a hassle to login your details every time

- Updates cause site to crash

Keep Informed and Keep Moving

The Alliant Mobile Banking app enables account holders to manage their money, deposit, check balances, pay bills and many other tasks while they are on the go. The app allows you to take care of banking business without slowing down.