Trip Miles app review: create a simple mileage log for employer reimbursement or tax purposes

Introduction

If you’re currently running a tight budget, or you need to track your vehicle’s mileage for employer reimbursement or tax purposes then this is likely the iPhone and iPad app for you as it provides everything you need to create a simple log with tons of customization options.

The best mileage tracking apps for iPhone and iPad 2021For those of you who are wondering, this app enables you to create entries for multiple drivers and vehicles, so you’ll find it to be entirely suited to fleets of vehicles or firms with several different drivers on the books.

I’ve personally found using this app to be incredibly easy, as is often the case with this kind of utility, so I think you’ll have no problem getting started and creating a detailed record of your vehicular expenses.

Easily Record All of Your Vehicular Expenses

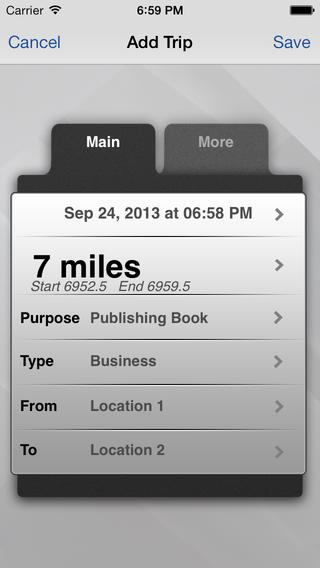

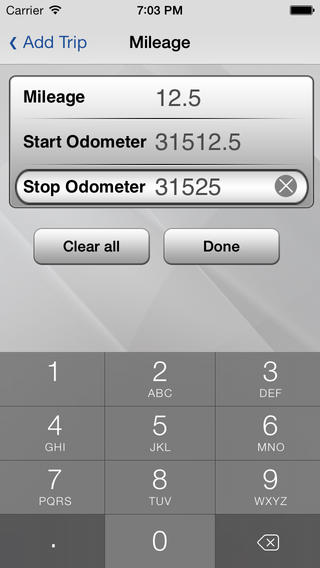

Trip Miles (Mileage log for Reimbursement or IRS) has been designed to provide you with a simple yet nonetheless powerful tool for recording vehicle-related expenses, including things like fuel, tolls, maintenance, and so on.

The best iPhone apps for doing your own taxesYou can sort these expenses into separate categories within the app to keep your records neat and tidy, so this is the ideal utility for use in a professional environment.

Create Detailed Expense Reports

If you need to present an expense report to your employer then you’ll find the reporting features to come in very handy. You can specify which timeframe you’d like covered and then export your records via email in .HTML or .CSV file format.

Best iphone and ipad appsFurther to this, you can create Advanced Reports which allow for loads of customization and options for filtering and ordering everything in exactly the way you want it presented.

Pros and Cons

Pros

- Create a simple mileage log for employer reimbursement or tax purposes

- Set up multiple drivers and vehicles if required

- Sort your expenses into separate categories such as fuel, maintenance, and tolls to keep your records nicely organized

- Create a handy digital backup copy of your records via email in .HTML and .CSV file formats

- Define the timeframe you would like to view, with high levels of customizability

- Create Advanced Reports for an even more in-depth look at your vehicular expenses

- Includes full support for miles and kilometers

Cons

- There is nothing negative to say about this app

Final Words

Trip Miles (Mileage log for Reimbursement or IRS) is definitely a great iPhone and iPad app that is easily up to the task of helping you log your expenses, so check it out and I doubt you’ll be disappointed!